Are Global Paper Industry Exports Growing?

Overview of Global Paper Industry Exports

The global paper industry is a significant player in international trade, with paper products being exported to various countries around the world. In this section, we will explore the current market size of the global paper industry exports, major exporting countries, fluctuations in market values, trends in global paper industry exports, and the impact of technological advancements on paper export statistics.

Current Market Size of the Global Paper Industry Exports

The global paper industry is expected to be among the top 10 largest global exporting industries in 2023, with exports valued at USD$190 billion. This indicates the tremendous scale and importance of the paper industry in the global export market. The pulp and paper industry heavily relies on exports, with around 30% of global pulp and paper grades produced being exported.

Major Players in the Export of Paper Products

Several countries play a significant role in the export of paper products. These countries have well-established paper industries, efficient production processes, and reliable supply chains. Some of the major players in the export of paper products include China, the United States, Germany, Japan, Canada, and Finland. These countries have a strong presence in both manufacturing and exporting of paper products.

Impact of Fluctuations in Market Values

Exports in the pulp and paper industry exhibit unpredictable trends, with values fluctuating significantly year by year. Fluctuations in market values can be attributed to various factors, such as changes in global demand for paper products, shifts in supply chain dynamics, and economic conditions in different countries. These fluctuations can have both positive and negative impacts on the paper export industry, affecting exporters’ profitability and market competitiveness.

Trends in Global Paper Industry Exports

Over the past few years, the global paper industry has witnessed several trends in its export market. One prominent trend is the increasing demand for sustainable and eco-friendly paper products. As environmental awareness grows, consumers and businesses are seeking paper products made from recycled materials and produced using sustainable practices. This trend has influenced the export market, with exporters focusing on offering environmentally friendly paper products to meet the demand.

Another significant trend is the rise of e-commerce, which has created new opportunities for the paper industry. The growth of online shopping has increased the demand for packaging materials such as corrugated boxes and paperboard. Exporters have capitalized on this trend by offering customized packaging solutions to meet the unique requirements of the e-commerce sector.

Impact of Technological Advancements on Paper Export Statistics

Technological advancements have played a crucial role in shaping the paper export industry. With the advent of digitalization and automation, paper manufacturers have improved their production processes, resulting in increased efficiency and productivity. This, in turn, has positively impacted paper export statistics by enabling exporters to meet the growing demand while maintaining cost-effectiveness.

Additionally, technological advancements have facilitated the development of innovative paper products with enhanced functionalities. For example, the introduction of specialty papers, such as water-resistant papers and papers with anti-bacterial properties, has opened up new export opportunities.

In conclusion, the global paper industry exports play a significant role in international trade, contributing to the economy of exporting countries. The market size of the global paper industry exports is substantial, and major players like China, the United States, Germany, Japan, Canada, and Finland dominate the export market. Fluctuations in market values can impact the paper export industry, while trends such as the demand for sustainable paper products and the rise of e-commerce present both challenges and opportunities for exporters. Technological advancements have further shaped the paper export industry, enabling exporters to improve efficiency, develop innovative products, and meet evolving market demands.

In the next section, we will explore the challenges and opportunities in the paper export industry, including the role of Market Optimizer in understanding market dynamics and strategies to mitigate challenges. Stay tuned!

Challenges and Opportunities in Paper Export Industry

The paper export industry is a dynamic sector that offers both challenges and opportunities for businesses looking to expand their operations. In this section, we will delve into the major challenges faced by the industry, explore the tools and strategies that can help mitigate these challenges, and discuss the potential opportunities for growth and expansion.

Major Challenges Faced by the Paper Export Industry

- Fluctuating Market Values: The paper export industry is highly susceptible to market fluctuations, with export values varying significantly from year to year. These fluctuations can be attributed to various factors, such as changes in global demand, geopolitical tensions, and economic instability.

- Competition from Digital Alternatives: With the increasing reliance on digital platforms and technologies, there has been a shift in consumer preferences towards digital alternatives for reading and communication. This trend poses a challenge for the paper export industry as it faces competition from e-books, online publications, and digital marketing platforms.

- Environmental Regulations: The paper industry is subject to strict environmental regulations, especially regarding deforestation and sustainable sourcing of raw materials. Compliance with these regulations can be challenging for exporters, requiring them to implement sustainable practices throughout their supply chains.

- Logistics and Transportation Costs: Exporting paper products often involves high logistics and transportation costs, especially for long-distance shipments. These costs can impact the competitiveness of paper exporters, particularly those located in remote areas or regions with limited transportation infrastructure.

To navigate the challenges in the paper export industry successfully, businesses can leverage tools like Market Optimizer offered by Fisher International. Market Optimizer is a comprehensive tool that provides valuable insights into market dynamics, helping businesses understand market size, competitiveness, and profit potential in various destinations.

Here is a table showcasing the major challenges faced by the paper export industry:

| Challenges | Description |

|---|---|

| Fluctuating Market Values | Export values in the paper industry can vary significantly from year to year, impacting profitability and market competitiveness. Changes in global demand, geopolitical tensions, and economic instability can contribute to these fluctuations. |

| Competition from Digital Alternatives | The growing reliance on digital platforms and technologies has led to a shift in consumer preferences towards digital alternatives for reading and communication. This trend poses a challenge for the paper export industry as it faces competition from e-books, online publications, and digital marketing platforms. |

| Environmental Regulations | The paper industry is subject to strict environmental regulations, particularly regarding deforestation and sustainable sourcing of raw materials. Exporters need to comply with these regulations and implement sustainable practices throughout their supply chains. |

| Logistics and Transportation Costs | Exporting paper products often involves high logistics and transportation costs, especially for long-distance shipments. These costs can impact the competitiveness of paper exporters, particularly those located in remote areas or regions with limited transportation infrastructure. |

Market Optimizer offers the following benefits to paper exporters:

- Market Size Analysis: By analyzing extensive data on market size, Market Optimizer enables businesses to identify potential export destinations with high demand for their products. This information helps exporters focus their efforts on markets that offer the greatest growth opportunities.

- Competitive Analysis: Market Optimizer helps businesses gain a competitive edge by providing insights into the strengths and weaknesses of their competitors. This information allows exporters to tailor their strategies and products to meet market demands effectively.

- Freight Cost Analysis: Exporting paper products involves significant freight costs, which can significantly impact profitability. Market Optimizer provides valuable insights into freight costs across different markets, helping businesses optimize their shipping strategies and reduce transportation expenses.

- Identifying Market Opportunities: Market Optimizer helps struggling mills analyze potential export opportunities and identify new markets where demand for paper products is growing. By leveraging the tool’s data-driven insights, paper exporters can uncover untapped opportunities for expansion.

Opportunities for Growth and Expansion

While the paper export industry faces challenges, there are also ample opportunities for growth and expansion. Some of the key opportunities in the paper export sector include:

- Emerging Markets: As developing economies experience economic growth, there is an increased demand for paper products, presenting opportunities for paper exporters to tap into these emerging markets. Countries in Asia, such as India, China, and Indonesia, are witnessing a rise in literacy rates and an increasing need for paper-based products.

- Sustainable Packaging: With the increasing awareness of environmental issues, there has been a growing demand for sustainable packaging solutions. Paper, being a renewable and recyclable material, offers an eco-friendly alternative to plastic packaging. Paper exporters can capitalize on this trend by supplying sustainable packaging materials to consumer goods companies.

- Digital Printing: Despite the rise of digital media, there is still a demand for printed materials, especially in sectors like publishing, marketing, and packaging. Digital printing technologies have made it possible to produce small print runs and customized products, creating opportunities for paper exporters to cater to niche markets with specialized printing needs.

In this section, we have discussed the major challenges faced by the paper export industry, the tools and strategies to mitigate these challenges, and opportunities for growth and expansion. By understanding and addressing these factors, paper exporters can navigate the export landscape successfully and make informed decisions.

Now, let’s move on to the next section where we explore key insights from specific regions in the paper export market.

Key Insights from Specific Regions in Paper Export

Highlight on the Paper Export Statistics from the Midwest Region of the U.S.

The Midwest region of the United States is a significant player in the paper manufacturing industry. With a strong presence in states like Wisconsin, the region contributes significantly to the country’s overall paper production. In 2021, the Midwest accounted for 16.8% of the total paper and paperboard production in the U.S. This just goes to show the importance of the region in the paper export market.

In terms of employment, the paper manufacturing industry in the Midwest has shown a 3.5% increase from 2020 to 2021, according to data from the Bureau of Labor Statistics. This growth has provided job opportunities and contributed to the region’s economy. Additionally, the average hourly earnings in the paper manufacturing industry have increased by 2.8% in the same period, reaching $25.50 per hour.

Shipments of paper and paperboard in the Midwest have also seen a positive trend. The value of shipments increased by 4.6% from 2020 to 2021, totaling $12.3 billion. This growth reflects the demand for paper products from the region and emphasizes its importance in the paper export market.

Overview of India’s Importing Trends of U.S. Recovered Paper

India remains the top importer of U.S. recovered paper, although it experienced a 27% decrease in purchases compared to the previous year. In the first nine months of 2023, U.S. recovered paper exports totaled 9.9 million metric tons, down 17.5% from the same period in 2022. The value of these exports also decreased by 32% to $1.87 billion.

This decline in imports from India can be attributed to various factors, including changes in market dynamics, fluctuations in demand, and stricter regulations. Despite the decrease in imports, India continues to be a crucial market for the U.S. recovered paper industry. As the demand for sustainable and recycled paper products grows, there is still potential for growth in the Indian market.

Trends and Insights on Paper Exports to Thailand and Malaysia

Paper exports to Thailand and Malaysia have shown some interesting trends and insights in recent years. Thailand reported an increase in imports, with a nearly 26% gain compared to the previous year. The country imported around 1.7 million metric tons of paper products. On the other hand, Malaysia’s imports remained steady at nearly 810,000 metric tons.

The combined imports of Thailand and Malaysia from the United States have significantly increased over the years. In 2020, the two countries imported a total of 965,000 metric tons, which increased to over 2.49 million metric tons in 2023, marking a 158% increase in just three years. This growth highlights the potential of these markets for paper exporters.

Impact of China’s Declining Fiber Imports from the U.S.

China’s decline in fiber imports from the United States has had a significant impact on the paper export industry. In 2023, China purchased slightly over 500,000 metric tons of U.S. fiber, reflecting a 13.8% decrease from the previous year. This is a significant drop considering China’s substantial imports of 4.8 million tons in previous years.

The decline in China’s fiber imports can be attributed to various factors, including changes in regulations, shifts in sourcing strategies, and economic factors. As a result, exporters of paper and paper products to China have had to adapt to this changing market dynamic.

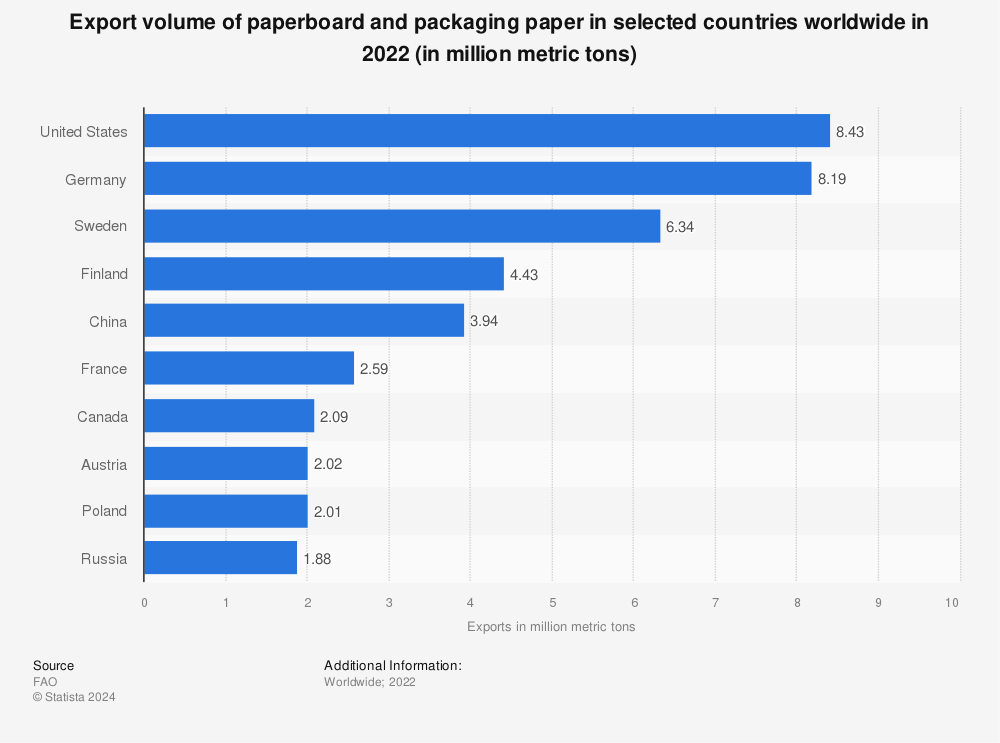

Comparison of Paper and Cardboard Exports Among Selected Countries

When comparing paper and cardboard exports among selected countries, it’s important to analyze the global trends and patterns. The FAO data provides insights into the export volumes of paper and paperboard in 2022, reported in 1,000 metric tons. While the actual figures may vary, the data offers a comprehensive overview of the export landscape.

Additionally, the Statista platform provides a more detailed breakdown of exports, allowing for a more in-depth analysis. It’s important to note that the export figures presented here are rounded for presentation purposes. To access the detailed source references and background information, a premium account is required.

In conclusion, the paper export industry encompasses various regions and markets, each with its own unique trends and insights. From the Midwest region of the U.S. to India, Thailand, Malaysia, and China, understanding the dynamics of these markets is crucial for paper exporters. The industry continues to evolve and adapt to changing market conditions, presenting both challenges and opportunities for growth. By staying informed and utilizing tools like Market Optimizer, paper exporters can navigate the export landscape successfully and make informed decisions.

FAQs about the Global Paper Industry Exports

What equation is used to calculate precision and recall in the context of paper export statistics?

In the context of paper export statistics, precision is calculated as the number of correct tokens shared between the prediction and the correct answer divided by the total number of tokens in the prediction. Recall is calculated as the number of correct tokens shared between the prediction and the correct answer divided by the total number of tokens in the correct answer.

How significant is the global paper industry in terms of export market size?

The global paper industry is expected to be among the top 10 largest global exporting industries in 2023, with exports valued at USD$190 billion, showcasing its substantial scale and importance in the global export market.

Which countries are major players in the export of paper products?

China, the United States, Germany, Japan, Canada, and Finland are some of the major players in the export of paper products, with well-established paper industries and efficient production processes.

What impact do technological advancements have on paper export statistics?

Technological advancements have positively impacted paper export statistics by enhancing production processes, increasing efficiency, and enabling the development of innovative paper products with enhanced functionalities.

How can businesses mitigate challenges in the paper export industry and leverage growth opportunities?

To navigate challenges and capitalize on growth opportunities, businesses can diversify products, invest in sustainable practices, strengthen international partnerships, and stay informed about market dynamics using tools like Market Optimizer.

In conclusion, we explored global paper industry exports and the challenges and opportunities within. The market size, major players, and technological impacts were discussed. Understanding challenges and using market trends can aid growth. Insightful data from regional exports like the U.S., India, and China was highlighted. Embracing strategies to navigate challenges can lead to future success in the paper export industry.