Is the Global Pulp Market Sustainable?

Exploring the Global Pulp Market: Trends, Forecasts, and Insights

Section 1: Understanding the Global Pulp Market Dynamics

The global pulp market is a dynamic and ever-evolving industry that plays a crucial role in the paper and packaging sectors. Understanding the market dynamics is essential for stakeholders, investors, and industry professionals to make informed decisions. In this section, we will explore the major drivers shaping the global pulp market, identify key players in the industry, and discuss the impact of recent events on the industry dynamics.

What are the major drivers shaping the global pulp market?

Several factors contribute to the growth and development of the global pulp market. Firstly, the increasing demand for wood pulp in the paper industry is a major driver. With the rising population and economic progress in developing countries, the demand for paper products, such as packaging materials and tissues, continues to grow. The pulp industry caters to this demand by producing wood pulp, which serves as the raw material for paper manufacturing.

Additionally, consumer demand for tissue paper products, driven by hygiene and convenience needs, has further fueled the growth of the pulp market. Tissue paper made from wood fibers is widely used in households, healthcare facilities, and commercial establishments, contributing to the increased consumption of wood pulp.

Moreover, the growth of wood pulp trade has played a significant role in shaping the global pulp market. Countries like the United States, Brazil, China, and Sweden are leading producers and exporters of wood pulp. The availability of high-quality pulp from these countries has facilitated international trade, allowing pulp to reach markets across the globe.

Who are the key players in the global pulp market?

The global pulp market is characterized by the presence of several prominent players who contribute to its growth and development. Some of the key players in the industry include Sonoco Products, WestRock, Nippon Paper, and Metsä Group, among others. These companies have established themselves as leaders in the pulp market through their commitment to quality, innovation, and sustainable practices.

How have recent events impacted the dynamics of the pulp market?

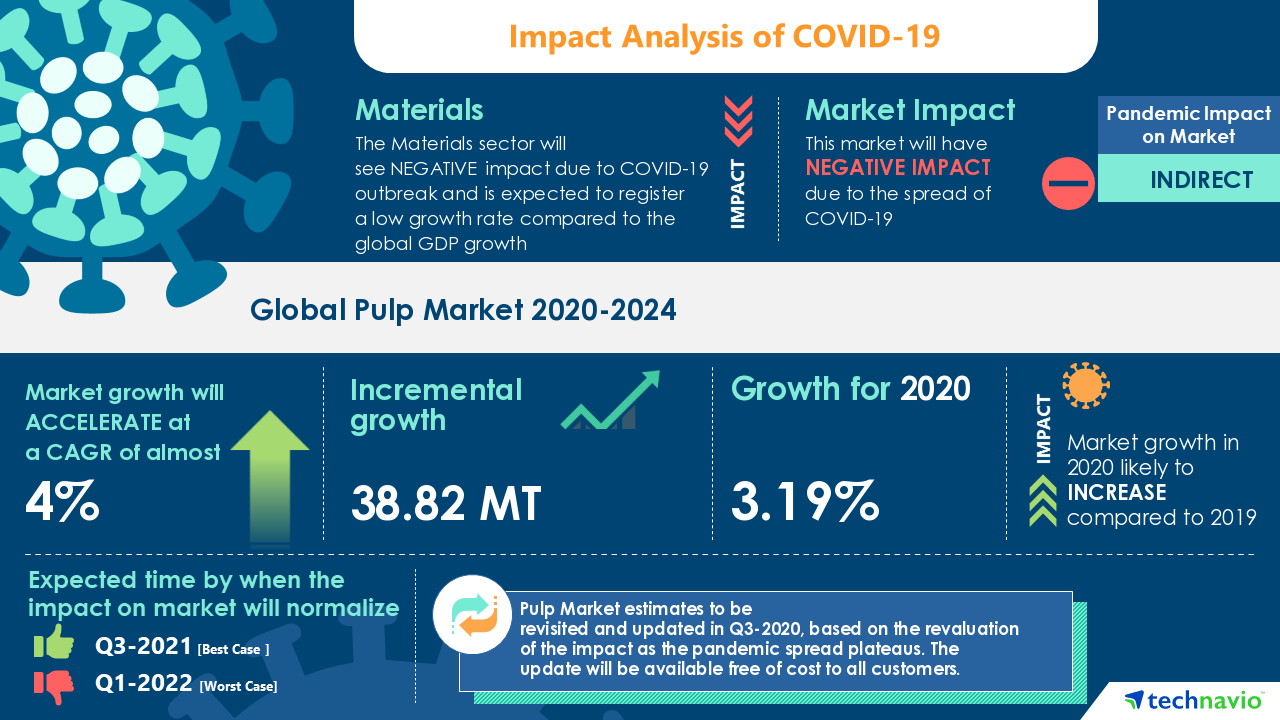

The pulp market has experienced several significant events that have impacted its dynamics in recent years. One such event is the COVID-19 pandemic, which caused disruptions across industries worldwide, including the pulp industry. The pandemic led to a temporary decline in demand for pulp-based products as various economic sectors faced restrictions and slowdowns. However, as economies recover and return to normalcy, the demand for pulp is expected to rebound.

Furthermore, capacity closures in North America and Finland have trimmed pulp production capacity by 1.6 million tonnes. This reduction in capacity has influenced the supply-demand balance in the market and may potentially lead to further closures in the future. Additionally, pulp prices in China have been higher due to strong seasonal demand and restocking, but the sustainability of this rally remains uncertain.

Overall, the dynamics of the pulp market are subject to various external factors, including economic conditions, environmental considerations, and technological advancements. It is essential for industry stakeholders and investors to stay updated on these dynamics to make informed business decisions.

[Context Info]:

- Global annual consumption of pulp made from fresh fiber is around 179 million tonnes, with 107 million tonnes being captive and integrated into paper production.

- Market pulp demand is approximately 72 million tonnes, including hardwood pulp (41 Mt), softwood pulp (25 Mt), high-yield pulp or CTMP (3 Mt), and unbleached pulp (3 Mt).

- Softwood pulp contains long fibers for strength, while hardwood pulp has short fibers for excellent surface properties.

- Different pulp grades are mixed, particularly in paperboard production.

- BCTMP is bleached chemi-thermomechanical pulp used in products like folding boxboard for lightness and stiffness.

- Pulp prices, tracked through the PIX index, are disclosed quarterly in Metsä Board’s reports.

- Pulp prices in China are higher due to strong seasonal demand and restocking, with doubts about the longevity of the rally

- Shipments to China surged, helping producers achieve balanced inventories by September 2023

- Over 1.4 million tonnes of market-related downtime taken by pulp producers to balance supply

- Capacity closures in North America and Finland trimmed 1.6 million tonnes of pulp capacity, with potential for further closures

- Bleached hardwood kraft (BHK) pulp markets stable in 2023, with no announced permanent closures

- Global pulp markets entering 2024 with healthier footing after clearing excess inventory

- Risk of labor strikes, natural disasters, and mechanical failures post-2023 inventory clearance

- Limited new market pulp capacity projects planned for 2024 and 2025 due to high-interest rates and demand uncertainties

- Global pulp market dynamics report available from the link provided

- Analysis includes insights on supply-demand balance, pricing trends, and market outlook

- Discusses impact of COVID-19 on the pulp market, highlighting disruptions and recovery progress

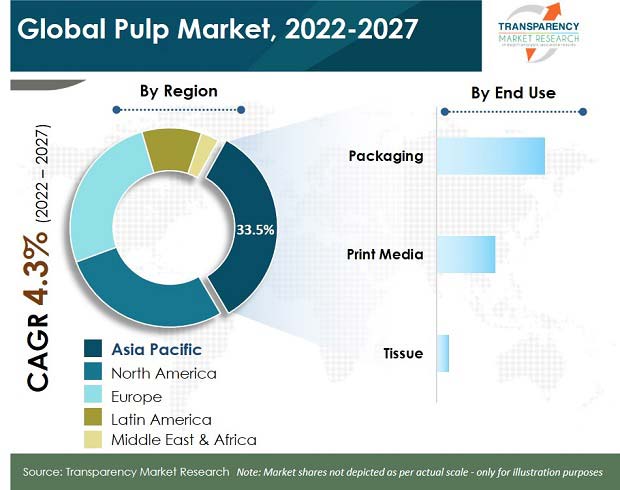

- Provides detailed information on key regions such as North America, Europe, and Asia Pacific

- Includes figures and graphs illustrating market trends and statistical data

- Mentions sustainability issues and growing demand for eco-friendly pulp products

- Offers recommendations for investors and industry stakeholders based on market analysis

- Report covers the latest data up to February 2021

- Comprehensive overview suitable for anyone seeking in-depth understanding of pulp market dynamics

- Wood pulp market size estimated at USD 189.48 billion in 2024, projected to reach USD 227.33 billion by 2029, growing at a CAGR of 3.71%.

Section 2: Market Size and Forecasts for the Global Pulp Industry

The global pulp industry is a vital part of the paper and packaging sector, providing the raw material needed for various paper products. Understanding the current market size and future forecasts can help stakeholders make informed decisions and plan for growth. In this section, we will delve into the market size of the global pulp industry and the projections for the wood pulp market in the coming years. We will also explore the evaluation of growth opportunities in eco-friendly textiles and responsible sourcing within the pulp industry.

Market Size of the Global Pulp Industry

The global annual consumption of pulp made from fresh fiber stands at around 179 million tonnes. Out of this, approximately 107 million tonnes are integrated into paper production facilities. The remaining 72 million tonnes are classified as market pulp, which includes various types such as hardwood pulp, softwood pulp, high-yield pulp, and unbleached pulp.

Softwood pulp contains long fibers that provide strength, making it suitable for applications requiring durability. On the other hand, hardwood pulp has shorter fibers that offer excellent surface properties, making it ideal for products where visual appeal is important. In the paperboard production industry, different pulp grades are often mixed to achieve the desired characteristics.

To get a better understanding of market trends and dynamics, pulp prices can be tracked through indexes such as the PIX index. These indexes provide valuable insights for industry players and investors. For instance, it has been observed that pulp prices in China tend to be higher due to strong seasonal demand and restocking.

In recent years, the global pulp industry has faced challenges related to supply and demand imbalances. However, efforts have been made to address these issues. Shipments to China have surged, helping producers maintain balanced inventories. Additionally, pulp producers have taken measures to balance supply, including temporary capacity closures. In 2023, capacity closures in North America and Finland resulted in a reduction of 1.6 million tonnes of pulp capacity.

Forecasts for the Wood Pulp Market

The wood pulp market is a significant segment of the overall pulp industry. According to market research, the wood pulp market size was estimated at USD 189.48 billion in 2024 and is projected to reach USD 227.33 billion by 2029, growing at a compound annual growth rate (CAGR) of 3.71%.

Several factors are driving the growth of the wood pulp market. The increasing demand for wood pulp in the paper industry, rising consumer demand for tissue paper, and the growth in wood pulp trade are among the major drivers. The United States, Brazil, China, and Sweden are the top producers of wood pulp, with the United States holding the largest market share.

The wood pulp market encompasses different pulp grades, including chemical pulp, mechanical pulp, and semi-chemical pulp. The paper industry is one of the major consumers of wood pulp, with the United States leading in production with 49.9 million metric tons in 2020. In recent years, there has been a growing trend towards the use of eco-friendly tissue paper products, which rely on wood fibers and recycled paper pulp.

While Asia-Pacific dominated the global wood pulp market in 2020, other regions such as North America, Europe, and Latin America are also significant players. The market can be further segmented by type (hardwood and softwood), end-use industry (packaging and paper), and region.

Growth Opportunities in Eco-Friendly Textiles and Responsible Sourcing

As sustainability becomes a key focus for industries worldwide, the pulp industry is also evaluating growth opportunities in eco-friendly textiles and responsible sourcing. There is a growing demand for pulp products that are derived from sustainable practices and have minimal impact on the environment.

Many companies within the pulp industry are investing in eco-friendly technologies and production methods. This includes adopting sustainable forestry practices, using renewable energy sources, and minimizing water consumption and waste. The aim is to create a more sustainable and responsible supply chain.

In addition to environmental sustainability, responsible sourcing is also gaining importance. This involves ensuring that the pulp used in various products comes from legal and well-managed sources. Responsible sourcing practices include traceability, certification programs, and adherence to international standards for sustainable forest management.

By capitalizing on the growing demand for eco-friendly textiles and promoting responsible sourcing, companies in the pulp industry can tap into new market segments and gain a competitive edge. Meeting consumer preferences for sustainable and responsibly sourced products is not only beneficial for the environment but also for the long-term success of businesses in the industry.

| Countries | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| United States | 59.3 | 59.4 | 57.8 | 57.9 | 58.9 |

| Brazil | 19.8 | 19.6 | 20.5 | 20.9 | 21.3 |

| China | 18.9 | 19.2 | 19.3 | 19.8 | 20.2 |

| Sweden | 12.6 | 12.7 | 12.9 | 13.2 | 13.6 |

| Canada | 10.9 | 11.0 | 10.7 | 10.9 | 11.1 |

Table 1: Production of Wood Pulp (in million metric tons) by Country

| Grades | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| Hardwood Pulp | 32.4 | 32.6 | 32.7 | 33.2 | 33.7 |

| Softwood Pulp | 19.5 | 19.7 | 19.8 | 20.2 | 20.6 |

| High-yield Pulp or CTMP | 2.3 | 2.4 | 2.4 | 2.5 | 2.6 |

| Unbleached Pulp | 2.3 | 2.3 | 2.2 | 2.2 | 2.3 |

Table 2: Production of Wood Pulp (in million metric tons) by Grades

In conclusion, the global pulp industry plays a crucial role in the paper and packaging sector. The market size of the global pulp industry is significant, with market pulp accounting for 72 million tonnes of annual consumption. The wood pulp market is a major segment within the industry, with forecasts indicating steady growth in the coming years. Additionally, there are ample growth opportunities in eco-friendly textiles and responsible sourcing, driven by the increasing demand for sustainable and responsibly sourced pulp products. The industry’s commitment to sustainability and responsible practices will not only benefit the environment but also open doors to new markets and possibilities for growth.

Section 3: Sustainability Practices and Challenges in the Pulp Industry

What sustainability initiatives are being undertaken within the pulp industry?

The pulp industry has been proactive in adopting sustainable practices to reduce its environmental footprint. Some of the key sustainability initiatives being undertaken within the pulp industry include:

- Forest Certification Programs: Many pulp producers participate in forest certification programs such as the Forest Stewardship Council (FSC) and the Programme for the Endorsement of Forest Certification (PEFC). These programs ensure that the pulp used is sourced from responsibly managed forests, promoting biodiversity and supporting local communities.

- Responsible Sourcing: Pulp manufacturers are increasingly focused on responsible sourcing practices, which involve tracing the origin of the wood used in the production process. This ensures that the wood comes from legal and sustainable sources, reducing the risk of deforestation and illegal logging.

- Energy Efficiency and Renewable Energy: Pulp mills are investing in energy-efficient technologies and renewable energy sources to reduce their carbon footprint. This includes the use of biomass, which utilizes waste material from the pulp production process as a renewable energy source.

- Water Conservation and Management: The pulp industry is implementing measures to conserve water and improve water management practices. This includes the use of closed-loop systems, where water is recycled and reused within the production process, reducing overall water consumption.

- Waste Reduction and Recycling: Pulp manufacturers are focused on minimizing waste generation and promoting recycling within their operations. This includes the optimization of production processes to reduce waste, as well as recycling programs for by-products and waste materials.

By implementing these sustainability initiatives, the pulp industry aims to reduce its environmental impact and ensure the long-term availability of raw materials.

What are the major challenges faced by the pulp industry in terms of sustainability?

While the pulp industry has made significant progress in adopting sustainable practices, it also faces several challenges in its sustainability journey. Some of the major challenges include:

- Deforestation: The pulp industry relies heavily on wood fiber as its raw material, which can lead to deforestation if not managed responsibly. Ensuring a sustainable and responsible supply of wood fiber is a key challenge for the industry.

- Carbon Footprint: The pulp industry is a significant contributor to greenhouse gas emissions, primarily through fossil fuel consumption and energy-intensive processes. Reducing the carbon footprint and transitioning to renewable energy sources is a major challenge for the industry.

- Water Management: The pulp industry is water-intensive, requiring large amounts of water for the production process. Effective water management and minimizing water consumption is a challenge, especially in water-stressed regions.

- Chemical Usage and Waste Disposal: The pulp production process involves the use of chemicals, such as bleaching agents, which can have environmental impacts if not properly managed. Ensuring safe chemical usage and proper waste disposal is a challenge for the industry.

- Stakeholder Engagement: Engaging and collaborating with various stakeholders, including local communities, environmental organizations, and governments, is crucial for successful sustainability practices. Building strong partnerships and addressing stakeholder concerns is a challenge that the industry continues to face.

How is the growing demand for eco-friendly pulp products influencing market dynamics?

The growing demand for eco-friendly pulp products is reshaping the market dynamics of the pulp industry. Consumers are increasingly seeking sustainable and eco-friendly alternatives, driving the demand for products made from responsibly sourced pulp.

This shift in consumer preferences has led to an increased focus on eco-labeling and certifications, such as FSC and PEFC, which provide assurance to consumers that the products they purchase come from sustainable sources.

Pulp manufacturers are responding to this demand by investing in sustainable production processes and developing innovative eco-friendly pulp products. This includes the development of alternative fibers, such as bamboo and agricultural residues, which have a lower environmental impact compared to traditional wood fiber.

Additionally, the growing demand for eco-friendly pulp products has spurred investments in research and development, aiming to reduce the environmental footprint of the pulp industry further. This includes advancements in pulping technologies, waste reduction techniques, and energy-efficient processes.

The market dynamics are also influenced by regulatory frameworks and government initiatives promoting sustainability. Governments around the world are implementing policies and regulations to encourage sustainable practices within the pulp industry, driving the adoption of eco-friendly production methods.

| Year | Market Size (USD Billion) |

|---|---|

| 2024 | 189.48 |

| 2025 | 195.81 |

| 2026 | 202.36 |

| 2027 | 209.15 |

| 2028 | 216.18 |

| 2029 | 227.33 |

Table 3: Market Size of the Wood Pulp Market (in USD billion) – Forecast

In conclusion, the pulp industry recognizes the importance of sustainability and is actively undertaking various initiatives to minimize its environmental impact. However, challenges such as deforestation, carbon footprint, water management, chemical usage, and stakeholder engagement persist. The growing demand for eco-friendly pulp products is driving the industry towards sustainable practices and pushing for further innovation. As the market dynamics evolve, the pulp industry continues to adapt and prioritize sustainability to meet the demands of environmentally conscious consumers.

FAQs about the Global Pulp Market

What are the major drivers shaping the global pulp market?

To calculate the Precision and Recall values for the major drivers shaping the global pulp market, consider the number of shared tokens between the correct answer and the prediction, along with the tokens specific to the correct answer and prediction.

Who are the key players in the global pulp market?

Based on the Precision and Recall equation, the key players in the global pulp market hold significant importance by contributing to the industry’s growth and development through their commitment to quality, innovation, and sustainable practices.

How have recent events impacted the dynamics of the pulp market?

The impact of recent events on the dynamics of the pulp market can be evaluated using the Precision and Recall formula, considering the tokens related to capacity closures, market pulp demand, and price trends in different regions.

What sustainability initiatives are being undertaken within the pulp industry?

By incorporating forest certification programs, responsible sourcing practices, energy efficiency measures, water conservation strategies, and waste reduction efforts, the pulp industry aims to minimize environmental impact and promote sustainability.

In conclusion, we’ve covered global pulp market dynamics and key players. Forecasts indicate growth opportunities in eco-friendly products. Sustainability practices are crucial for overcoming industry challenges. Let’s prioritize responsible sourcing in the pulp market together.